Live Animals

Live Animals Vegetable Products

Vegetable Products Fats and Oils

Fats and Oils  Foodstuffs and Beverages

Foodstuffs and Beverages Mineral Products

Mineral Products Chemical Products

Chemical Products Plastic and Rubbers

Plastic and Rubbers Animal Hides and Fursking

Animal Hides and Fursking Wood Products

Wood Products Paper Goods

Paper Goods Textiles

Textiles Footwear and Headwear

Footwear and Headwear Stone and Glass

Stone and Glass Jewelry

Jewelry Base Metals

Base Metals Machines

Machines Transportation

Transportation Instruments

Instruments Arms and Ammunition

Arms and Ammunition Miscellaneous

Miscellaneous Arts and Antiques

Arts and Antiques Unclassified

Unclassified

-

Global

Global

-

Asia

Asia

- South-eastern Asia

- Eastern Asia

- Southern Asia

- Western Asia

- Central Asia

-

Europe

Europe

- Northern Europe

- Eastern Europe

- Southern Europe

- Western Europe

-

Americas

Americas

- Northern America

- Latin America and the Caribbean

-

Africa

Africa

- Northern Africa

- Sub-Saharan Africa

-

Oceania

Oceania

- Australia and New Zealand

- Polynesia

- Melanesia

- Micronesia

- All Economies

- APEC Countries

- APTA Countries

- Arab League 22 Countries

- Asean 10 Countries

- BRICS Countries

- Central and Eastern Europe 17 Countries

- CPTPP 11 Countries

- CSRICOM 15 Countries

- China,Japan and South Korea

- EAEU 5 Countries

- EU 27 Countries(No United Kingdom)

- EU 28 Countries

- FVEY Countries

- Greater China

- G20 Countries

- G7 Countries

- GCC 6 Countries

- IPEF 14 Countries

- Latin American Region

- Least Developed Countries

- NATO Members

- Norden 5 Countries

- Mekong 5 Countries

- RCEP 10+5 Countries

- RCEP 10+4 Countries(No China)

- SCO 8 Countries(Including China)

- USMCA 3 Countries

Product Description

Global Potential Market mainly serves the following three scenarios:

1. When determining the direction and priority of products and markets for national or regional export strategies and trade policy orientation, government departments can use Global Potential Market to comprehensively sort out information about their own export potentials; change the traditional sample analysis and repetitive research methods, and shift from subjective judgement-based analysis to full-sample analysis and judgement by means of big data from a global perspective.

2. Trade promotion organisations can make use of the Global Potential Markets to provide detailed guidance to enterprises and help them understand undeveloped export opportunities.

3. Exporters can use Global Potential Markets to identify attractive target markets for their export products.

ReportGlobal Potential Market Methology

Global Potential Market

Find Business, go to  Global Trade Monitor(GTM)

Global Trade Monitor(GTM)

Global Trade Monitor(GTM)

Global Trade Monitor(GTM) Global Potential Market

Methology

SINOIMEX

Tong Nian, Chiyu, Wang Xiaofei

January 16, 2024

DRAFT-20240116

Introduction:

Against the background of increasing global economic uncertainty, it has become an urgent issue for governments, trade promotion agencies and export enterprises to grasp the direction of foreign trade development, optimize the structure of export products and target potential international markets. SINOIMEX utilizes the theoretical idea of international trade gravity model, combines with its global trade statistics database and macroeconomic statistics released by official agencies of various countries, and builds a powerful interactive market analysis tool - "Global Potential Market".

Global Potential Market serves three main scenarios:

1.When determining the focus and priority of products and markets for national or regional export strategies and trade policy orientation, government departments can make use of the Global Potential Market to comprehensively sort out information on the country's export potential; change the traditional sample analysis and repetitive research methods, and transform the analysis means from subjective judgments to a full sample analysis and research and judgment by means of big data from a global perspective.

2.Trade promotion agencies can use Global Potential Market to provide detailed guidance to enterprises on untapped export opportunities.

3.Exporters can use the Global Potential Market to identify attractive target markets for their exports.

Traditional trade gravity modeling tools are mainly designed to calculate and display the export potential ranking or expected amount of export products of exporting countries in global or target markets. For users, these generalized rankings and estimates have gradually lost their practical value in the current highly digitalized and transparent international trade market environment. Global Potential Market weakens the importance of the result ranking at the conclusion level, opens up the evaluation parameters of the gravity model and various trade facilitation parameters to the users, and refines the main analysis methods, weight planning and ranking functions into each parameter to provide the users with completely personalized analysis of the gravity model.

At the same time, in order to obtain comprehensive and timely dynamics of international trade potential, the Global Potential Market abandons the traditional calculation method of using historical panel data as the main data set, and extends the calculation data to 205 countries and economies around the world, and all the commodity categories involved in international trade from 2007 to the present. In this paper, we will start from the general application of the international trade gravity model, and gradually introduce the assessment parameters and calculation methodology adopted by the Global Potential Market.

1. Gravitational Modeling:

The trade gravity model has its origins in the gravitational model of physics under the theory of classical mechanics proposed by Issac Newton, which is formulated as follows:

![]()

G = 6.67×10-11 is the gravitational constant, M1、M2 is the mass of the two objects, respectively, and d is the center-of-mass distance between the two objects. In this theoretical framework, any two material particles in the universe will be attracted to each other by gravitational force, which is proportional to the product of the masses of the two particles and inversely proportional to the square of the distance between the particles. The "trade gravity model" derived from this physics theory is a theoretical approach in economics that can explain and predict trade flows between two countries based on two elements: the size of their economies and the distance between them. The principle of the trade gravity model is that, just as the attraction between two particles of matter is positively and negatively proportional to their mass and distance from each other, the trade flow between two countries is also positively and negatively proportional to the size of the economies of the two sides and the distance between them.

As a theoretical approach to modeling the degree of trade association between countries by borrowing from the fundamental theorems of physics, the theoretical premise behind the construction of the gravity model of trade can be understood as a parallel between human interaction and Newton's classical physics; in physics, the action of an individual particle has endless and unpredictable possibilities, but the activity of a macroscopic system composed of a group of particles can be modeled by mathematical probability; similarly, it is extremely difficult to mathematically describe the actions of a single person and predict the logic of their behavior, but it is possible to model the behavior of a group of people using mathematical probability studies. Similarly, it is extremely difficult to describe mathematically the actions of a single individual and to predict the logic of his behavior, but it is possible to simulate the behavior of a group of people using the mathematical study of probability (Carrothers, 1955); this logical thinking was pioneered in the social sciences by Comte (1854), Isard (1954) and Carrothers (1955), among others who pioneered the application of physics in the social sciences; at the same time, Walter Isard, an economist who made a significant contribution to the founding of the gravity model of trade in the field of gravitational socio-physical structure, considered this way of thinking a necessary precondition for the development of physical reasoning in the social sciences, without which the simulation of physical structures in sociology or economics would be meaningless due to a lack of logical consistency and meaningless (Isard, 1954). Based on this theory (premise), the gravity model of trade, which reduces the behavior of trade between countries to the set of contributions made by each firm in a country that participates in international trade, naturally possesses the possibility of explaining and predicting trade between countries by means of the metaphor of the laws of classical physics at the level of the universal economy (from the country to the region or the firm).

The Dutch economist Jan Tinbergen, who is widely regarded as a pioneer in the application of physics theory to international trade and as the author of the basic theory of the trade gravity model, used the physics gravity formula, adjusted with economic elements, as a simple basis for the econometric estimation of bilateral trade flows between two countries and summarized the basic form of the gravity model of international trade, i.e., the trade gravity model (Tinbergen, J. 1962.). Jan Tinbergen's student, Linnemann (1966), based on his main idea, determined the basic operational formula of the trade gravity model as follows:

![]()

In this formula, T is the abbreviation of Trade, i and j can represent any two countries, Tij represents the trade flow between country i and country j, K is a constant, and Yi and Yj represents the economic size of country i and country j respectively. When the gravity model is applied to international trade, the economic dimension must be considered first; as a standard parameter used to measure the economic scale of a country, GDP (Gross Domestic Product) can, to a certain extent, illustrate the economic development of a country and represent positive economic parameters such as economic prosperity and disposable income of residents. So in general, the economic scale Yi and Yj in the trade gravity model is measured by the GDP of the two countries.D is the abbreviation of Distance, Dij represents the distance between country i and country j. The economic scale Y in the trade gravity model is measured by the GDP of the two countries. According to the formula, it can be deduced that the larger the value of Yi and Yj as the numerator, the larger the value of Tij , i.e., the larger the bilateral trade flow; on the contrary, when the distance of the denominator is elevated, the trade flow will decline. In the trade gravity model economic size is usually regarded as an inward force, which is positively correlated with trade flows, while distance is regarded as an outward force, which is negatively correlated with trade flows (Luigi Capoani, 2023). The positive correlation between economic size and trade flows can be explained by the fact that a large economic size also implies a large market size and a rise in the supply capacity and volume of demand for foreign goods.

Unlike the common application of GDP, the interpretation of Dij has long been controversial in the theory of trade gravity modeling.Walter Isard, in his short-term analytical study of location theory and trade theory, suggests that the distance variable acts on the social world in roughly the same way as it does on the natural world (Isard, 1954). However, in the actual performance of international trade, trade flows will not be affected by geographic distance alone, so the distance Dij in the trade gravity model, as one of the direct factors affecting trade flows, cannot be determined by the geographic concept of distance alone. Adjustments to the distance parameter in earlier studies have focused on assessing the impact of distance on transportation costs in international trade; for example, Hummels (1999) proposed replacing straight-line distances between countries with the physical distance of goods transported, while Limão and Venables (2001) added the impact of infrastructure quality on transportation costs to this list.Mayer and Zignago (2005) created a methodology that weights the distances between cities between countries based on the proportion of the country's population residing in each city, replacing the location of specific cities with the calculated abstract centers. However, with the further development of related theories, the adjustment at the transportation-related level gradually evolved into the consideration of economic, cultural, social, technological, linguistic, and other correlations between the two countries, and in this way constituted a more comprehensive and relevant negative correlation of the role of distance in gravitational modeling (Torre and Wallet, 2014).The CAGE model published by Pankaj Ghemawat The CAGE model published by Pankaj Ghemawat summarizes the composition of distance into four dimensions: cultural, administrative, geographic, and economic, and evaluates and predicts trade potential by fitting each dimension into an evaluation formula (Pankaj Ghemawat, 2001). The CEPII database, an internationally popular training set for trade gravity modeling, classifies the components of Dij into more than 70 inter-country correlations including geographic distance, language, population, religion, legal system, colonial relations, cultural ties, and so on. To summarize, distance Dij , as the only negative force in the trade gravity model, represents a collection of association dimensions between two countries in cultural, administrative, geographic, and economic dimensions. The effect of these correlation dimensions may be reflected in the negative top-down economic and trade impacts of the two countries (the impacts of geography, space, culture, trade policies, preferences, tariff barriers, etc. in the economic and trade relations); and for the actual impact elements of international trade flows ----- exporters, these correlation dimensions measure the basic conditions of a certain market as an export destination country/place in different perspectives and the ease and cost of exporting to it, among other things.

2. Methodology:

2.1. Average viable trade and trade growth potential.

In the field of practical applications, gravity models are widely used in empirical studies targeting the assessment of the trade growth potential of bilateral trade between countries due to their strong predictive power in estimating exchange flows between countries, as they provide sufficient degrees of freedom (the composition of Dij , the choice of bilaterals to be studied, and the possibility of covering a wide range of market forms) and can be used to assess the impact of various trade policies (Head and Mayer, 2014). One theory developed in this process is that the fitted values of the trade gravity model can represent the average feasible trade between country pairs in an inter-country trade network, i.e. potential trade. This allows for the fact that potential trade growth can be estimated in terms of the difference or ratio between expected average trade and actual trade between country pairs (Dadakas et al., 2020; Armstrong, 2007). The U.S. Department of Commerce's Foreign Trade Administration's Market Diversification Tool is constructed using this logic. The Market Diversification Tool evaluates whether the U.S. import share gap, a parameter that refers to whether the U.S. share of imports in a given market is too high or too low, is a function of how much U.S. products are traded between that country and a larger region (usually the same geographic region). It is the difference between the import share of U.S. products in that country and that of a larger region (usually a group of similar countries in the same geographic region), and the import share gap exists if the U.S. import share in that region is greater than the import share in that country (https://www.export.gov/Market-Diversifiiation). This approach can be understood as assuming a constant value for the distance Dij between the United States and all countries within a region by limiting the scope of the geographic area analyzed and estimating it using this variant of the trade gravity model. The International Trade Center's (ITC) Export Potential Map (EPM) approach to estimating export potential is similarly inspired by this theory, utilizing the idea of maximum possible trade in the Stochastic Frontier Gravity Model (SFGM) to estimate the amount of trade that could be achieved between the two countries in an ideal world free of all trade frictions. In an ideal world without any trade friction, the maximum potential export value and the actual export value that can be realized between the two countries are assumed to be equal, and the actual difference between the maximum potential export value and the actual export value is calculated by adding the parameter adjustments, including the GDP and a variety of trade-related impacts.

Using the idea of estimating the average feasible trade between country pairs, we elicit an algorithm for trade growth potential under the gravity model in the parameterization of Global Potential Market:

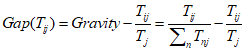

Potential trade between country i and country j, expressed as Gap(Tij ), is equal to country i's average viable trade share in country j, Gravity, minus country i's actual trade share in country j (or total imports of country j). At the product-specific level, country i's potential product-specific exports to country j, Gap (Vij ), are equal to country i's average feasible trade share of country j's exports of the specific product minus country i's actual trade share of country j's exports of the specific product. On this basis, the first half of the formula is adjusted by the factor influencing economic and trade relations between the two countries, distance Dij , so that it incorporates realistic influences to lead to an estimate of average feasible trade that is closer to the real situation. If GAP < 0, then country i's trade in country j's market for a product is greater than what we would expect based on the average feasible trade volume calculated from country i's share of the world market, probably because the two countries are geographically proximate to each other and have already established a good supply and demand relationship. If GAP > 0, then the trade volume of a product from country i in country j is lower than what we would expect based on the average feasible trade volume calculated from the world market share of country i. The higher the value of GAP, the higher the potential for a product from country i to be traded in the market of country j, and vice versa. In calculating country i's share of country j's average viable trade, Global Potential Market uses the 205 reporting countries in its system as the scope for the GAP calculation.

In choosing the composition of influencing factors Dij , Global Potential Market adopts tariff, price and distance as the main parameters, with customs clearance facilitation, business environment and cultural difference as the supplementary ones. However, in order to ensure that the results are not easily dispersed, the Global Potential Market uses the parameters of Comparative Tariff Advantage (CTA)ij , Comparative Price Advantage (CPA)ij , and Comparative Distance Advantage (CDA)ij to constitute the parameters of trade growth potential based on the gravitational model.

![]()

![]()

If the total amount of exports of a product from country i to country j in the analyzed time period, Vij , is taken as the base value, the trade growth potential, GAP, is the growth potential of the base value measured in proportional form, from which the amount of potential for exports of a product from country i to country j can be estimated.

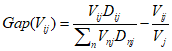

![]()

It should be noted, however, that the trade growth potentials calculated here are based on static system calculations of international trade networks and do not take into account any dynamic growth in the volume of trade itself, so they can also be viewed as a simulation of the reallocation of the international trade market distribution system in a static situation. To address this shortcoming in the assessment, Global Potential Market incorporates an assessment of the future growth of Vij on top of the trade growth potential parameter in the static system, which modifies the trade growth potential parameter to make it more realistic in terms of its consideration of dynamic changes in trade potential.

![]()

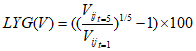

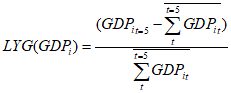

Growth(Vij) is defined as the average of two annual growth rates of exports from country i to country j for selected products over a period of five years forward from the year of analysis: the Compound Annual Growth Rate (CAGR) for the entire five-year period and the Partial Compound Annual Growth Rate (LYG) for the period between the last year and the five-year average. Using the average of these two growth rates allows us to be able to weigh trade in the most recent years with a smoothed balanced growth profile, and focuses on strengthening the overall impact of trends in the final year of the five-year series. The trade growth potential parameter, which incorporates the effect of actual trade growth between country i and country j, and the amount of potential growth in country i's exports of a product to country j, takes its final value:

![]()

![]()

Since the trade growth potential based on the trade gravity model is too idealized when calculating the amount, it is not suitable to be used as the final reference, the trade growth potential and the amount parameter are listed alongside the rest of the parameters in Global Potential Market, and are mainly used for the assessment of cross-country comparisons.

2.2. Match between supply and demand:

According to the rationale of the trade gravity model, the matching of supply capacity and demand volume of the two countries is a fundamental judgment of whether the two countries will be attracted to each other in terms of trade and economic ties. The trade growth potential parameter does not take into account whether the dynamic trends in the exporting country's supply capacity and the market country's demand volume are consistent with supporting bilateral trade growth, and whether changes in the macro supply and demand capacities of the two countries will sufficiently influence their supply and demand capacities at the level of a particular product. In order to develop a valid measure of this influence, we have used the supply-demand match parameter to complement the trade growth potential parameter in this respect. The Global Potential Market uses GDP as a measure of supply and demand capacity in its calculation of the match between supply and demand, and calculates it separately for exporting country i and market country j.

![]()

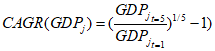

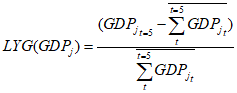

The growth of supply capacity in country i is defined as the average of two annual growth rates of country i's GDP over the five-year period preceding the year of analysis: the compound annual growth rate (CAGR) over the entire five-year period, and the partial compound annual growth rate (LYG) between the last year and the five-year average. j's growth in demand volume is calculated using the same methodology.

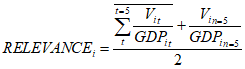

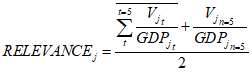

The degree of foreign trade dependence was first proposed by the American economist W.A. Brown in his book "Reinterpretation of the International Gold Standard System during 1914-1943", which he called "interdependence". The degree of foreign trade dependence refers to the proportion of a country's or region's total foreign trade to the gross domestic product (GDP), which reflects the close degree of linkage between a country's or region's economy and international trade, and is one of the macro-indicators for measuring the scale and level of development of a country's or region's open economy. The adjusted foreign trade dependence algorithm is used here to measure the impact of changes in the supply capacity of the exporting country and the demand volume of the market country on the supply and demand of a product in foreign trade. Total foreign trade is replaced by country i's exports of a given product Vi and country j's imports of that product Vj . The impact parameter RELEVANCE calculates the average of the five-year shares of country i's and country j's total exports or imports of a given product V and their countries' GDPs for the five-year period ahead of the year of analysis, averaged over the current year's share of the year of analysis to make the results more up-to-date.

![]()

![]()

![]()

Ultimately, the growth parameter of the overall supply or demand capacity of the two countries is multiplied by the product-specific RELEVANCE parameter to obtain a measure of the product-specific supply assessment parameter, SUPPLY, and the demand assessment parameter, DEMAND, with the supply-demand matching parameter, SD, ultimately taken to be the lesser of the overlap between SUPPLY, the supply capacity of country i, and the volume of demand, DEMAND, in country j. The larger the parameter, the better matched the supply and demand capacity of the two countries for a given product. The larger the SD parameter, the better the match between the supply and demand capacities of the two countries for a given product, which also implies that the two countries are less likely to experience a supply deficit or demand deficit in the face of future potential growth. The GDP data used in Global Potential Market are from the United Nations Statistics Division - Gross Domestic Product (GDP) data for all countries worldwide (https://data.un.org/), and the total merchandise exports and imports for all countries worldwide are from SINOIMEX - Global Trade Statistics Database (www.sinoimex.com).

2.3. Distance:

The Global Potential Market distance parameter assesses the distance between the 205 countries it covers. The main purpose of the distance parameter here is to measure the actual transportation costs incurred in international trade logistics between countries, mainly by sea and land, which may be abstract and therefore the rules for calculating it do not exactly correspond to the real distances.

Distance calculation rules:

1.The distance from each country to neighboring countries is enforced as a fixed minimum.

2.Distances between all countries with sea or canal ports with easy access to the sea are calculated using the average distance between major ports in the respective countries by combining latitude, longitude and the length of the earth's arc. If the two countries belong to a unified secondary region, such as China and Japan belong to the same - Asia - East Asia, then calculate the distance between their top 5 cargo ports and then take the average, less than 5, then take all existing ports and take the average. Because of the modern developed land transportation system, in some special areas, the combination of latitude and longitude and the earth's arc length is used to calculate the distance from one country to another country belongs to the secondary region of the main ports; for example, China - Latin America, only China's throughput of the top 5 ports to Latin America's top five ports distance, so the calculation of the distance of exporting from China to Argentina and the distance of exporting from China to Brazil is the same.

3.Distances between capitals are calculated using a combination of latitude, longitude and the length of the earth's arc when both countries are landlocked and belong to the same continent.

4.For certain country pairs where direct sea transport is not possible because one of the countries is landlocked or there are no effective shipping routes, land or mixed land-sea transport distances are used.

Global Potential Market global cargo port location and capacity data from Humanitarian Data Exchange - World Port Index (humdata.org).

2.4. Compare distance advantage:

In the heyday of the Age of Sail, the lack of effective preservation and high-speed transportation technologies meant that raw meat or fish could usually be sold in Europe no farther than a 30-mile radius around the place of origin; however, the American colonies of the same period were able to export barrels of salted pork (heavily salted) from North America to the European continent on sailing ships.

The comparative distance advantage is a correction for the distance parameter. The distance parameter of the Global Potential Market is used as a measure of transportation costs. However, while transportation costs vary across products, bilateral distances are constant and therefore not practical in differentiating transportation costs across products. For example, perishable products are sensitive to distance and are therefore usually imported from neighboring countries, while distance is less important for non-perishable products.

Using this principle, the Comparative Distance Advantage Parameter assesses whether trade in a product between two countries has an advantage in terms of transportation distance by operating on the distance parameter, thereby mapping its impact on the assessment of potential markets. This is a two-way comparative advantage calculation.

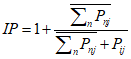

The comparative distance advantage EDIST of exporting country i for exporting product p to market country j:

![]()

The closer the distance from exporter i to target market j is to the average distance of the exporter's exports (the smaller the absolute difference), the greater the distance advantage EDIST of exporting a product to that market. In order to make the results of the calculation reflect the actual capacity situation between the two countries, the average distance is weighted here using the share of export value of export country i's exports to each market (the share within the total amount V of export country i's exports of product p) in the latest complete year.

The comparative distance advantage IDIST of market country j's imports from exporter i's imports v:

![]()

The closer the distance from market country j to exporting country i is to the average distance of the market country's imports (the smaller the absolute difference), the greater the distance advantage ISDIST for imports from exporting country i. The average distance from market country j to exporting country i is the same as the average distance of market country's imports. In order to make the results of the calculations reflect the actual capacity situation between the two countries, the average distance is weighted here using the share of imports of market country j from each market in the latest complete year (the share of importer j's imports of product p within the total amount of product V).

Here the comparative distance advantage between neighboring countries is set to be maximum, i.e., EDIST = 1 or IDIST = 1.

Finally, EDIST and IDIST are compared and the smaller value is taken as the Comparative Distance Advantage CDAij (Comparative Distance Advantage) of product V exported by exporter i to market country j.

![]()

In addition to the assessment of transportation distances for specific products, the information embedded in comparative distance advantages can also help to identify the best products to export to specific markets.

2.5. Highest average tariff:

The maximum average tariff is a measure of the cost of tariffs that a product would have to pay to export to a potential market. The product granularity for Global Potential Market is HS4 digits. The average tariff is calculated as the average amount of tariff on the HS end-code products under an HS4 product. The highest average tariff indicator is the tariff measure that best approximates the actual situation by including the standard tariff rate as well as the various preferential tariff rates in the calculation.

The global tariff data we use in Global Potential Market comes from the WTO Global Tariff Database (http://tariffdata.wto.org/). Tariffs are unpredictable across countries globally, and real-time updates of tariff changes are not readily available for use in calculations; to ensure data consistency, the WTO global tariff data used in Global Potential Market is updated to the most recent year for which the data is complete.

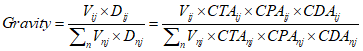

2.6. Comparative tariff advantages:

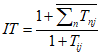

Comparative tariff advantages are based on the operation of the highest average tariff parameter. The tariff advantage of the potential market country is evaluated from both the supply side and the demand side for the exporting country exporting a product. Comparative tariff advantage ET on the supply side is calculated by the formula:

The denominator is the tariff imposed by market country j on imports of a specific product from exporting country i, and the numerator is the average tariff that exporting country i needs to be charged for exporting a specific product to all countries in the world. If ET is greater than 1, it means that country i has a tariff advantage in exporting the particular product to country j. The greater the comparative tariff advantage, the greater the comparative tariff advantage for country i. The greater the comparative tariff advantage, the greater the impact on the export potential of country i in exporting the specified product to country j.

The denominator of the demand-side comparative tariff advantage IT is the tariff imposed by market country j on imports of a specific product from exporting country i, and the numerator is the average tariff imposed by market j on imports of a specific product from all countries in the world. If IT is greater than 1, it means that country j has a tariff advantage for importing the specific product from country i. A larger comparative tariff advantage has a greater impact on the import potential of country j for importing the specified product from country i.

In practice, the comparative tariff advantage that exists on both the demand and supply sides is usually considered simultaneously, and the overlap between the supply-side advantage and the demand-side advantage is the effective portion, so the final value of the Comparative Tariff Advantage CTAij (Comparative Tariff Advantage) is the lesser of ET and IT:

![]()

The analysis of comparative tariff advantage is a closed system operation based on an ideal. In an ideal system that does not take into account factors such as product quality, demand and supply volumes, and regional consumer preferences, goods with lower tariffs would have lower export cost floors (export cost here represents a series of sunk costs in the export trade process, such as marketing, promotion, logistics, and tariff costs) when exported, thus allowing for lower selling prices and generating more exports; and the demand side would prefer goods with lower cost floors in the import The demand side will also prefer goods with lower costs in the import process and thus lower price floors, thus allowing more imports. However, in the analysis of comparative tariff advantages, the ideal system cannot exist; tariffs affect international trade by affecting prices, and the actual effect of comparative tariff advantages on export and import potential needs to be adjusted by adding parameters that assess prices.

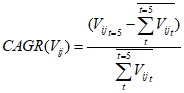

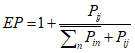

2.7. Compare price advantages:

The Comparative Price Advantage parameter assesses the impact of commodity prices on the export and import potential of a given product from both the supply side and the demand side, and complements the Comparative Tariff Advantage by means of the elasticity of substitution coefficients for suppliers and purchasers. The comparative price advantage on the supply side is:

The denominator of the supply-side comparative price advantage is the sum of the historical price of exporting country i's exports of a specific product to market country j and the historical average price of exporting country i's exports of a specific product to countries around the globe, and the numerator is the historical price of exporting country i's exports of a specific product to market country j. The closer the result of the right-hand side of the denominator is to one, the more price advantage country i has in exporting the specified product to country j, and the greater the impact on the export potential of country i in exporting the specified product to country j.

The denominator of the demand-side comparative price advantage is the sum of the historical price of the specific product imported by market country j from exporting country i and the historical average price of the specific product imported by market country j from countries around the world, and the numerator is the average price of the specific product imported by market country j from countries around the world. The closer the result of the right-hand side of the denominator is to one, the more it means that country j has a price advantage in importing the specified product from country i, and the greater the impact on the import potential of country j in importing the specified product from country i.

The overlapping part of the supply-side advantage and the demand-side advantage is the effective part in practical applications, and the final value of the Comparative Price Advantage CPAij (Comparative Price Advantage) is taken to be the smaller value:

![]()

Comparative price advantage serves to adjust the comparative tariff advantage by capturing the actual price advantage of a given commodity price on the supply side and the demand side, in order to bring the assessment of market potential closer to reality. This adjustment can also be interpreted as a kind of elasticity of substitution coefficient for suppliers and purchasers under conditions of price changes.

Global Potential Market uses import and export commodity price data from SINOIMEX - Global Trade Statistics Database (www.sinoimex.com), which covers 205 countries or economies. Due to the difference in the caliber of statistics among countries in international trade statistics, there may be multiple units of quantity/weight for the same type of commodity or the same commodity, such as kilogram (kg), number (No), liter (L), etc. At the same time, due to the unavailability of specifications of commodities and density, it is impossible to effectively convert each unit, therefore, the price parameter used in the "Global Potential Market" does not take into account the difference of units in the calculation. Therefore, the price parameters used in Global Potential Market are calculated without considering the difference in units, and errors are inevitable when statistics are collated by simply dividing the total amount by the cumulative quantity (regardless of units).

3. Other evaluation parameters:

3.1. Contract performance costs:

The cost of contract performance, which measures the ease or difficulty of resolving commercial disputes in the local court system of a potential market, is estimated by calculating the cost of enforcing a contract, including court fees, attorney's fees, and the cost of enforcing a hypothetical standard case between a buyer and a seller, as a percentage of the value of the claim, to resolve a dispute with a local business in a potential market. This data is expressed in percentage terms.

The indicators used in Global Potential Market are based on the World Bank Doing Business Statistics.

3.2. Customs compliance costs:

Customs compliance costs measure the sum of border compliance costs and document compliance costs essential to the logistics of importing a shipment into a potential market.

Border compliance costs are the costs, in United States dollars, of complying with customs regulations, required inspections and handling goods at the border.

Document compliance costs are the costs, in United States dollars, of obtaining, preparing, processing and submitting all import documents required by the market. This includes all documents prepared by the freight forwarder, such as certificates of origin or customs declarations.

Customs clearance compliance costs do not account for tariffs or other taxes and transportation costs.

The basis for the measures used in Global Potential Market is the World Bank cost of Doing Business: Trading Across Borders Statistics.

3.3. Rule of law environment:

The rule of law environment is an indicator of the soundness of and compliance with the rule of law in a potential market, calculating the likelihood of local violent and commercial crime by collecting the perceptions of the local population regarding their confidence in and compliance with the laws and regulations of the country (place). This indicator may be particularly instructive for firms exporting knowledge-intensive products.

The indicator takes values from -2.5 to 2.5, with higher scores indicating better rule of law.

The basis for the measurements used in Global Potential Market is derived from the World Bank Worldwide Governance Indicators (WGI).

3.4. International logistics performance:

International logistics performance is measured using the World Bank's "International Logistics Performance Index". The index is a survey of international trade operators from 160 countries and territories, which provides feedback on the logistics friendliness of each country or territory in which they operate and with which they trade. The survey consists of the following six sections:

Customs: how efficient is the country's customs system

Infrastructure: What is the quality of infrastructure for trade and transport?

International freight forwarding: the possibility of easily arranging the transportation of goods at competitive prices

Logistics capacity: what is the quality of logistics services, including trucking, freight forwarding and customs brokerage?

Tracking and tracing: what is the ability to trace goods within the country

Timeliness: whether the goods reach their destination within the expected time frame

The scores for these six factors were compiled into a total score ranging from 1 to 5, with higher scores being better.

3.5. FTAFTA Agreement:

Determines whether the potential market has a Free Trade Agreement (FTA) with the exporting country, where some of the exporting country's products enjoy preferential tax rates and many other incentives in countries with which the exporting country has an FTA. This indicator is defined as 1 for countries that have an FTA with the exporting country and 0 for countries that do not.

The measures used in Global Potential Market are based on the WTO-Regional Trade Agreements Database (WTO | Regional Trade Agreements):https://rtais.wto.org/UI/PubliiMaintainRTAHome.aspx)。

References:

[1] Carrothers GAP (1955) An historical review of the gravity and potential concepts of human interaction. https://doi.org/10.1080/01944365608979229org/10.1080/01944365608979229

[2] Comte A (1854) System of positive polity, or treatise on sociology. Instituting the Religion of Humanity. Burt Franklin, New York

[3] Isard W (1954) Location theory and trade theory: short-run analysis. https:// doi.org/10.2307/1884452

[4] Linnemann H (1966) An econometric study of International Trade Flows. North Holland Publishing Co, Amsterdam

[5] Tinbergen J (1962) Shaping the world economy; suggestions for an International Economic Policy. The Twentieth Century Fund

[6] Mayer T, Zignago S (2005) Market access in global and regional trade. Working Papers, CEPII research center

[7] Limão N, Venables AJ (2001) Infrastructure, geographical disadvantage, transport costs, and trade. World Bank Econ Rev 15(3)

[8] Hummels DL (1999) Toward a geography of trade costs. https://doi.org/10.2139/ssrn.160533

Torre A, Wallet F (2014) Regional development and proximity relations. Edward Elgar, Cheltenham

[9] Pankaj Ghemawat (2001) Distance Still Matters. Harvard Business Review 79, no.8

[10] Capoani Luigi (2023) Review of the gravity model: origins and critical analysis of its theoretical development. SN Business & Economics. 3. 10.1007/s43546-023-00461-0.

[11] Head K, Mayer T (2014) Gravity equations: workhorse, toolkit, and cookbook. https://doi.org/10.1016/B978-0-444-4314-1.00003-3

[12] Dadakas D, Ghazvini Kor S, Fargher S (2020) Examining the trade potential of the UAE using a gravity model and a Poisson pseudo maximum likelihood estimator. The Journal of International Trade & Economic Development, 29(5)

Global Potential Market Methology Download PDF

Global Potential Market Methology Download PDF